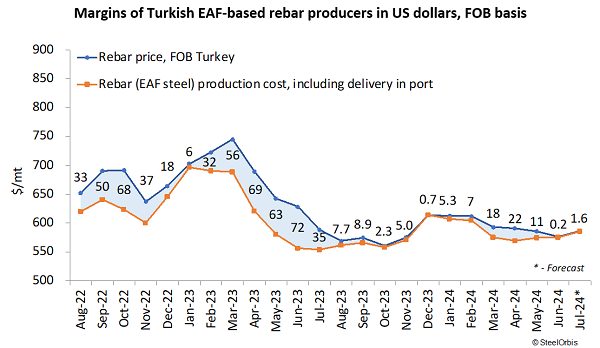

The recent electricity tariff adjustment by the Turkish government has raised numerous discussions regarding its impact on the steel industry and its production costs. Turkish mills have been gradually losing competitiveness in the international markets, for instance against the DRI-based EAF producers in North Africa and the GCC, and BF-based Asian suppliers as well. As a result, the possible increase in production costs is considered to be a serious issue since Turkey’s margins in the flats segment are already squeezed while in the rebar sector they are close to zero.

According to the government’s statement, starting from July the electricity tariffs in Turkey have been increased by 38 percent for residential buyers, while for the high-volume consumers, including the steel industry, tariffs have increased by 20 percent for price peaks. Although the impact on production costs is not considered dramatic so far, it will still make the situation for Turkish mills more challenging, particularly for longs exporters.

According to the latest evaluations, the actual increase in electricity prices will overall vary within 10-20 percent from June indicators depending on the mill, its number of active shifts and production hours. The estimated effect on production costs in this case is an increase of around $4-7/mt, according to SteelOrbis’ calculations.

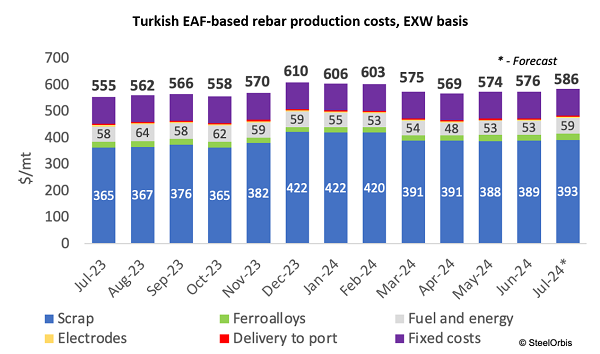

Spot electricity price peaks for industrial users increased by 10-20 percent from the June indicators and steel product costs will increase by at least $4-7/mt, according to SteelOrbis’ calculations. Along with the expected slight rebound in import scrap segment, the higher electricity tariffs are expected to result in a $10/mt rise in EAF-based rebar production costs in July to $580-590/mt FOB. In the domestic market, the same factors are expected to bring costs up in July by around two percent to TRY 19,000-19,100/mt, SteelOrbis estimates.

In June, Turkish mills’ export margins for finished steel had dropped to minimal values, especially in the rebar segment. Turkish mills might be forced to raise finished product prices in July and August, risking being left without profits against the background of rising energy costs. If Turkish mills fail to achieve higher workable rebar export prices, they will find themselves in a difficult situation and may further reduce production, which is already at around half capacity on average in Turkey. Those operating a diverse production will focus even more on other products such as flats, wire rod and sections.

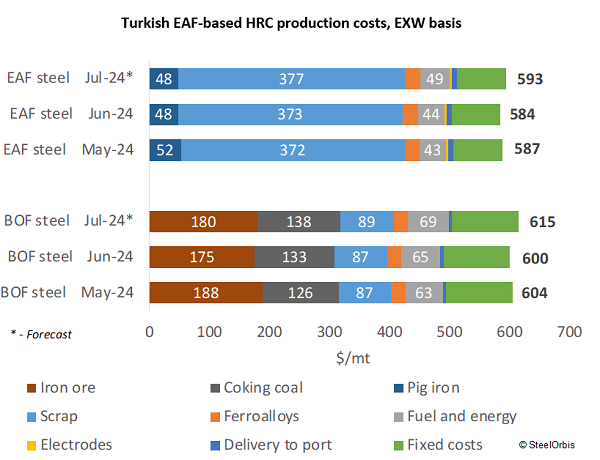

In the HRC segment, mills will also face an increase in their production costs due to higher electricity prices and, obviously, the effect on scrap users will be slightly greater compared to production based on iron ore usage.

According to SteelOrbis’ calculations, EAF-based HRC producers in Turkey will have a $5/mt electricity-related cost increase, while, with the expected scrap price increase, the overall rise is estimated at $9/mt. As for the BOF route, the electricity price hike is foreseen to result only in around a $2-4/mt increase, but again depending on working hours.

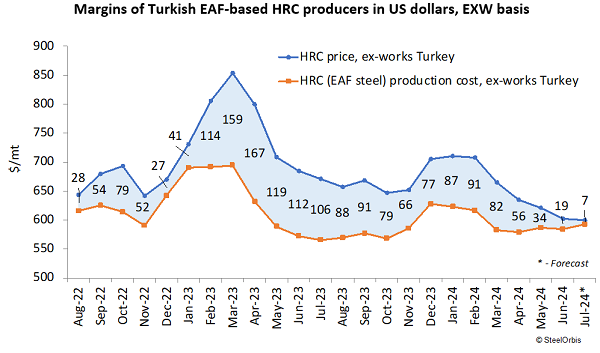

Despite the similar cost increase expected to be seen for both EAF-based rebar and HRC production, flats mills will still find themselves is a better position in terms of margins. Currently, the production cost from scrap to HRC is estimated at slightly above $200/mt versus the current local price levels of $580-590/mt, which puts pressure on sales profitability. However, mills can balance this with import slab usage, particularly slab of Russian origin. By the end of July, however, Turkey’s HRC is expected to rebound due to some restocking in the EU before the holiday and a less aggressive stance from China. As a result, the margins of HRC producers are expected to be less tight.