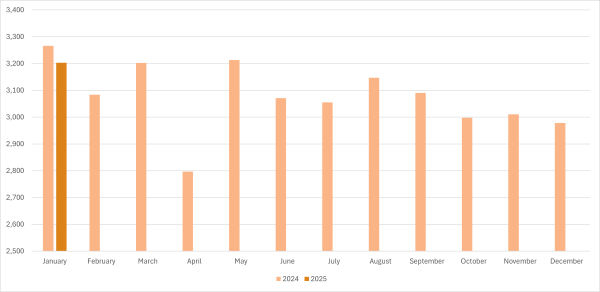

According to a statement released by the Turkish Steel Producers’ Association (TCUD), in January this year crude steel production in Turkey decreased by 1.9 percent year on year to 3.2 million mt, ranking seventh among crude steel producing countries globally. With this performance, Turkey has become the largest steel producer in Europe, leaving Germany behind.

In the given month, finished steel consumption in Turkey rose by 2.6 percent year on year to 3.58 million mt.

In January, Turkey’s steel exports increased by 23.1 percent to 1.12 million mt, while the value of these exports rose by 14.7 percent to $763.45 million, year on year. Looking at the exported products, flat and long product exports in the given month amounted to 374,359 mt and 686,373 mt, respectively, with an increase of 6.6 percent and 25.3 percent year on year, while semi-finished product exports amounted to 61,071 mt.

In the first month of the current year, Turkey’s steel imports increased by 24.9 percent to 1.73 million mt, while the value of these imports moved up by 11.3 percent to $1.19 billion, both year on year. Looking at the imported products, flat and long product imports in the given month amounted to 900,737 mt and 98,444 mt, respectively, with an increase of 22.4 percent and a decrease of 0.4 percent year on year, while semi-finished product exports increased by 32.9 percent year on year to 729,863 mt.

In the given period, Turkey’s steel export to import ratio increased to 63.7 percent, from 61.8 percent recorded in the same period of the previous year.

According to the statement, US president Donald Trump's removal of tariff exemptions for countries such as Canada, Mexico, the EU, the UK, Brazil, Japan and South Korea has increased expectations that conditions in which the Turkish steel industry will compete on equal terms with these countries in the US market will be created. On the other hand, Trump's tariff decision caused a 15 percent increase in prices in the US domestic market, raising the possibility that this situation may be gradually reflected in input and finished steel prices in other countries. The EU's announcement of possible precautionary measures against the US's tariffs raised concerns. TCUD believes that under current conditions, protectionist moves will continue throughout the year and 2025 will be a year when trade wars intensify.