According to a statement released by the Turkish Steel Producers’ Association (TCUD), in April this year crude steel production in Turkey increased by seven percent year on year to three million mt, the first year-on-year increase recorded this year so far, while in the first four months production declined by one percent year on year to 12.26 million mt.

In the given month, finished steel consumption in Turkey rose by 3.1 percent year on year to 3.29 million mt, while in the January-April period the country’s finished steel consumption decreased by 6.3 percent year on year to 12.04 million mt.

In April, Turkey’s steel exports increased by 14.4 percent to 1.17 million mt, while the value of these exports rose by six percent to $813.06 million, year on year. In the first four months, the country’s steel exports rose by 17.3 percent to 4.96 million mt, while the value of these exports increased by 7.6 percent to $3.36 billion, both year on year. Flat and long product exports in the January-April period amounted to 2.11 million mt and 2.64 million mt, respectively, with increases of 19.7 percent and 11.2 percent year on year, while semi-finished product exports amounted to 212,320 mt.

In the fourth month of the current year, Turkey’s steel imports decreased by 9.1 percent to 1.35 million mt, while the value of these imports moved down by 13.0 percent to $1 billion, both year on year. In the January-April period, the country’s steel imports increased by 0.9 percent to 5.58 million mt, while the value of these imports moved down by 6.6 percent to $4.03 billion, both year on year. Looking at the imported products, flat and long product imports in the first four months amounted to 2.71 million mt and 511,377 mt, respectively, with a decrease of 3.9 percent and an increase of 14.6 percent year on year, while semi-finished product imports amounted to 2.36 million mt.

In the first four months, Turkey’s steel export to import ratio increased to 83.44 percent, from 72.42 percent recorded in the same period of the previous year.

According to the TCUD statement, the prevention of scrap trade has become a global trend with developments such as the inclusion of scrap restrictions in the EU Steel and Metal Action Plan. Scrap demand is expected to increase by 20 percent by 2030 amid decarbonization efforts. Considering that Turkey is the largest scrap importer with a 20 percent share of international trade and possible further restrictions, the country needs to meet its scrap requirements from alternative markets and inputs, while measures need to be implemented to increase local scrap production.

Meanwhile, considering that the country’s imports will continue to increase in 2025 and that tight economic policies will delay growth in consumption, the optimistic expectations seen at the beginning of the year are forecast to become more cautious due to recent developments.

In addition to current protectionist measures and antidumping duties, the TCUD emphasized that Turkey’s inward processing regime should be structured to prioritize domestic supply to limit imports from Far Eastern countries, especially China. According to the association, ongoing efforts to end the safeguard measures against the Turkish steel industry and implementing measures to reduce input costs will boost support for improving competitiveness and closing the country’s current account deficit.

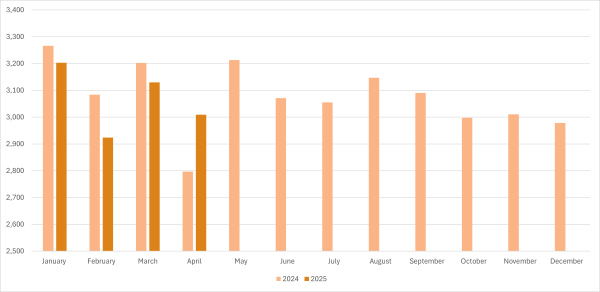

Turkey's crude steel production - April 2025