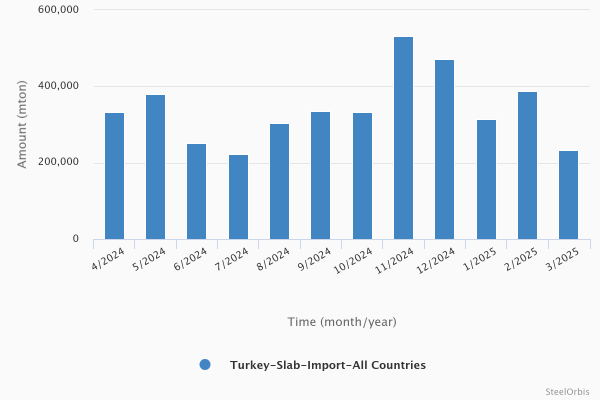

In March this year, Turkey’s slab imports amounted to 231,907 metric tons, down by 40.2 percent compared to February and by 24.7 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the revenue generated by these imports totaled $113.58 million, decreasing by 40.2 percent compared to the previous month and down by 36.4 percent year on year.

In the January-March period, Turkey's slab imports amounted to 935,016 mt, up 4.3 percent, while the value of these imports decreased by 6.4 percent to $464.52 million, both year on year.

Turkey’s slab imports - January-March 2025

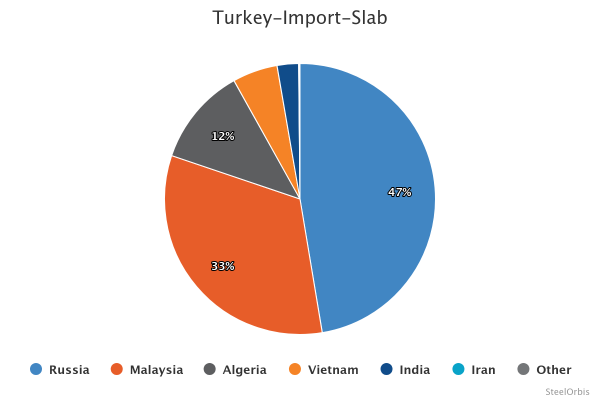

In the given period, Turkey’s largest slab import source was Russia, which supplied 443,543 mt, up by 152.2 percent year on year. The main reason for Turkey’s stronger interest in Russian origin was the advantage of a single plentiful source of slabs to be supplied with a short lead time, while most of the other available origins are Asian with at least 30 days sailing time to Turkey. Another reason for higher volumes of imports from Russia is that its slab has been the lowest priced in the market, even if supplied by a non-sanctioned Russian mill, while Malaysian and Indonesian material was offered at significantly higher levels during most of the evaluated period since the suppliers were focused on higher-paying destinations compared to Turkey. Therefore, during most of the first quarter of 2025 Turkish HRC producers were finding it attractive to import slabs from Russia at prices much lower than their own production costs.

In addition to Russia, and while Ukraine has been absent in the slab market, Algeria has started to become a second preferred nearby source of supply, having supplied 109,683 mt of slabs to Turkey in the first three months. However, the trade flow is coming from Tosyali Algerie, which started its production relatively recently, while the buyer is Turkey’s Tosyali Holding, which produces HRC in the Iskenderun region.

The fewer imports of slabs from Asia in the given period was due to rather stable prices and the focus of some suppliers on other markets which may offer better prices, like Europe. In particular, in the first three months of 2024, imports of slabs from Indonesia to Turkey totaled over 100,000 mt, while this year there were no supplies from this country. “Indonesia’s Dexin is highly focused on sales of HRC to Europe and slabs at a lower price are not the best option for them,” an Asian trading source said. At the same time, though imports of slabs from Malaysia were also down, the total volume in 2025 so far is still above 300,000 mt amid the absence of duty for Malaysian semis in Turkey, which brings a better price and a profit for the sellers when selling to Turkey.

Turkey’s slab import sources in the January-March period this year:

| Country | Amount (mt) | |||||

| January-March 2025 | January-March 2024 | Y-o-y change (%) | March 2025 | March 2024 | Y-o-y change (%) | |

| Russia | 443,543 | 175,852 | 152.2 | 113,814 | 57,842 | 96.8 |

| Malaysia | 307,249 | 405,477 | -24.2 | 100,315 | 200,180 | -49.9 |

| Algeria | 109,683 | - | - | - | - | - |

| Vietnam | 50,251 | 50,441 | -0.4 | - | - | - |

| India | 24,100 | 25,393 | -5.1 | 17,589 | - | - |

| Iran | 176 | - | - | 176 | - | - |

| United Kingdom | 13 | - | - | 12 | - | - |

Shares in Turkey’s slab imports - January-March 2025