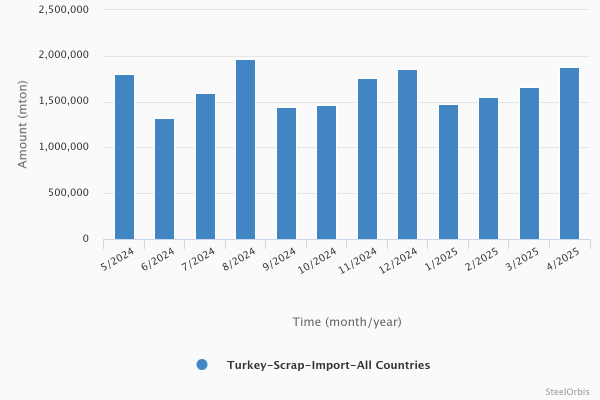

In April this year, Turkey's scrap import volume increased by 24.1 percent year on year and went up by 12.8 percent month on month to 1.88 million metric tons, according to the data provided by the Turkish Statistical Institute (TUIK). The value of these imports totaled $719.9 million, up 15.8 percent year on year and 8.9 percent month on month.

In the January-April period, Turkey's scrap imports amounted to 6.57 million mt, down 3.8 percent, while the value of these imports decreased by 16.3 percent to $2.47 billion, both year on year.

Turkey’s scrap imports - Last 12 months

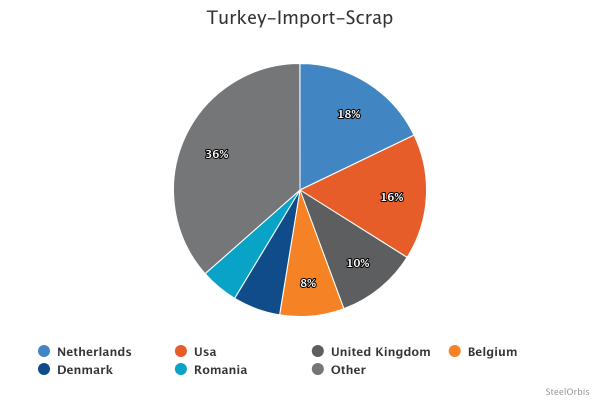

In the given period, Turkey imported 1.17 million mt of scrap from the Netherlands, up 17.6 percent year on year, with the Netherlands ranking as Turkey's leading scrap import source, ahead of the US which supplied 1.05 million mt in the given period, down 23.2 year on year, and the UK which supplied 685,074 mt of scrap, down six percent year on year.

The main reason for such a critical reduction in the volume of scrap supplied from the US is the Trump-related tariff policies, which through multiple and rather chaotic announcements resulted in a price rush in the flat steel market in the US and so local scrap prices were also rising rapidly. At the same time, while local scrap prices were rising in the US, the export yards were cutting prices, which is a rare situation and it affected the overall availability of scrap for export from this source. As a result, Turkish mills were finding it safer to increase purchases from the EU, particularly from the Netherlands. Another reason for the generally lower scrap imports in the January-April period this year is that part of the required raw materials were substituted by cheap billet imports, since Turkish mills have been using this alternative to have a tighter grip over their production balance and costs.

Turkey's top 10 scrap import sources in the January-April period are as follows:

| Country | Amount (mt) | |||||

| January-April 2025 | January-April 2024 | Y-o-y change (%) | April 2025 | April 2024 | Y-o-y change (%) | |

| Netherlands | 1,173,936 | 998,013 | 17.6 | 331,132 | 194,255 | 70.5 |

| US | 1,055,722 | 1,373,767 | -23.2 | 279,369 | 364,623 | -23.4 |

| UK | 685,074 | 728,998 | -6.0 | 22,747 | 152,239 | -85.1 |

| Belgium | 539,903 | 479,428 | 12.6 | 129,484 | 38,113 | 239.7 |

| Denmark | 398,468 | 359,654 | 10.8 | 117,179 | 73,621 | 59.2 |

| Romania | 318,651 | 308,055 | 3.4 | 104,202 | 74,206 | 40.4 |

| Lithuania | 295,505 | 345,356 | -14.4 | 87,859 | 56,388 | 55.8 |

| Germany | 242,451 | 209,436 | 15.8 | 121,705 | 24,358 | 399.7 |

| Russia | 235,661 | 84,795 | 177.9 | 53,830 | 163 | >1000.0 |

| France | 228,945 | 243,281 | -5.9 | 86,586 | 83,593 | 3.6 |

Shares in Turkey’s scrap imports - January-April 2025