WSD forecasts global steel demand will rise 0.4 percent to 1.86 billion mt in 2025 (the mid-case assumption) reflecting: a) a 0.7 percent decline in Chinese apparent steel demand; b) a 1.4 percent rise in non-Chinese apparent steel demand; and c) steel buyers outside of China adding to their inventory.

WSD expects relatively modest gains in non-Chinese steel demand in 2025. The increase amounts to 1.4 percent in our “mid-case” demand growth scenario:

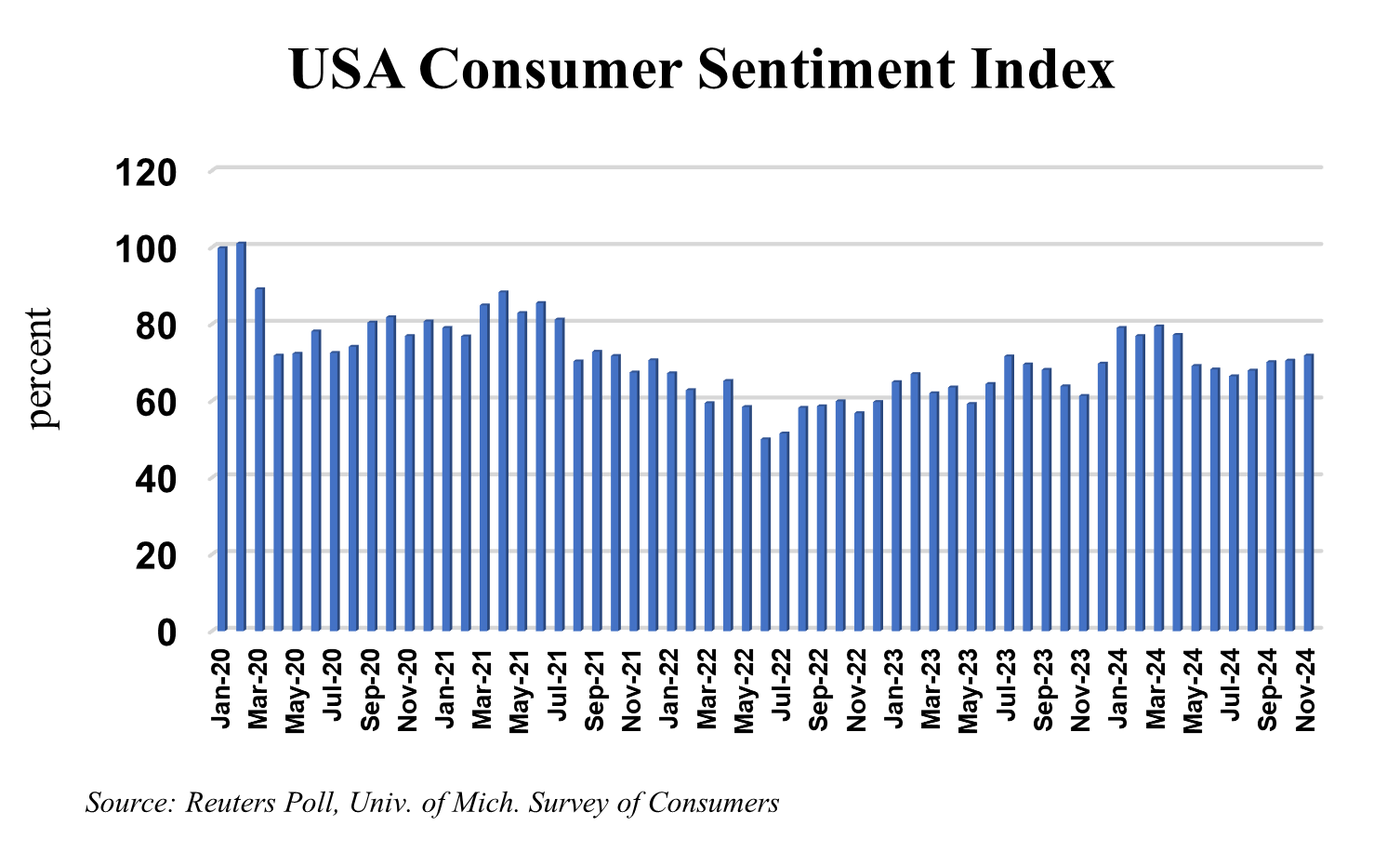

- Consumer sentiment surveys are largely unfavorable in Europe, Japan, and other Developed-World economies with the USA perhaps the lone exception at present.

- Still-high interest rates have now limited global funds for Developing World governments and their local investors for several years – this lagging headwind will no doubt take some time to dissipate. Many countries outside of China are just now overcoming the last vestiges of the financial restraints caused by the post-Covid surge in inflation.

- Government policymakers in a rising number of Developed and Developing countries in 2025 continue to deal with the fallout of tighter budgets due to ageing populations, rising entitlements, higher debt servicing costs and slowing exports (especially in the case of manufacturing export-oriented economies such as Japan, South Korea, and elsewhere) as well as housing and construction market crises.

- Manufacturing “trade wars,” almost certainly likely to escalate under the Donal Trump presidential administration, are likely to keep at least some investors on the sidelines as they await greater certainty. Countries such as India, Vietnam, Indonesia, and others that stood to benefit from the wave of manufacturing divestment away from China that began during the first Trump administration, will likely have to wait at least another 6-12 months before investors gain the confidence necessary to unleash a new wave of spending.

-

- In this regard, WSD is increasingly of the viewpoint that 2026 could be the next year of above-average steel prices and industry profits as the combination of lower interest rates and higher investor confidence conspire to create a significant surge in steel demand ex-China. This could perhaps coincide with a significant reduction in Chinese steelmaking capacity and net exports, leading to the next “short age” for hot-rolled band on the world export market.