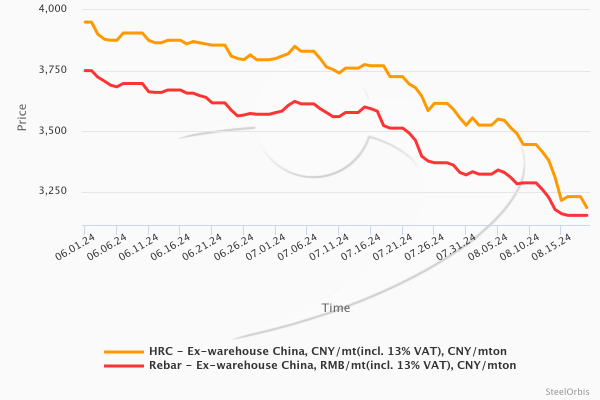

Over the past week, the gap between local Chinese HRC and rebar prices has narrowed significantly to a historical low as demand for Chinese HRC has been heavily impacted by both poor domestic consumption and growing concerns overseas with more AD investigations in the main sales destinations facing Chinese sellers.

The gap between local Chinese HRC prices and local rebar prices on ex-warehouse basis has fallen from over RMB 200-250/mt or $28-35/mt in June and July this year to as low as RMB 32/mt or $4.5/mt on August 19, dropping to a historically low level. Average HRC prices in China have lost RMB 45/mt today again, coming to RMB 3,185/mt ($446/mt) ex-warehouse, while rebar has been stable since Friday at RMB 3,153/mt ($441/mt) ex-warehouse, according to SteelOrbis’ data.

“There is a big price division between debar and HRC and now the gap between the respective steel futures prices is only RMB 20/mt, which shows an abnormal weakness of HRC demand,” a Chinese trader said. One of the Chinese mills, who has both HRC and longs/billet exports, also said that the pressure on the former from overseas AD investigations has been very strong recently, while HRC exports have been critically important for steelmakers, which were relying on them in the situation of weak local demand.

According to customs statistics, China’s steel sheet/plate exports totaled 41.63 million mt in the January-July period this year, up 28.4 percent, while bar shipments for export rose by 10.3 percent year on year to 7.01 million mt.

In late July, Vietnam’s Ministry of Industry and Trade (MOIT) announced that it had decided to initiate an antidumping (AD) investigation on imports of HRC from China and India.

Also, India’s Director General for Trade Remedies (DGTR) has started an antidumping investigation on alloy or non-alloy hot rolled flat products from Vietnam, which has indirectly impacted Chinese suppliers as well. According to market sources, at the end of the day China will also be included and the BIS certificate of Chinese mill Benxi Steel for exports to India will expire in the October-November period and, according to sources, it is very unlikely that it will be extended in the short run.

In addition, Turkey’s General Directorate of Imports of the Ministry of Commerce has published the final declaration report for the antidumping investigation that the country had launched against hot rolled coil from China, India, Japan and Russia in October last year. The dumping margin for Chinese HRC exporters ranges from 20.56 percent to 57.75 percent.

There is also a tightening of safeguard policies in Europe, including imports of vehicles from China.

$1 = RMB 7.1415